The Italian green, social and sustainable (GSS) bond market in 2023 started with a record Sustainable-linked bond issue by oil&gas company ENI Spa offered to the retail market. The initial offer of EUR1bn was expanded to EUR2bn due to a larger than expected request by the market that reached orders for more than EUR10bn reporting a record oversubscription rate of 10x. The bond is due in 2028 and offers a fixed interest rate of 4.3% with a 0.5% step up in case the company does not reach the sustainability targets (KPIs). ENI is committed to achieve (a) Net Carbon Footprint Upstream (Scope 1 and 2) equal to or less than 5.2 MtCO2eq as of 31 December 2025 (-65% from 2018 baseline); and (b) installed capacity for renewable electricity generation of 5 GW or more as of 31 December 2025.

2022 market review

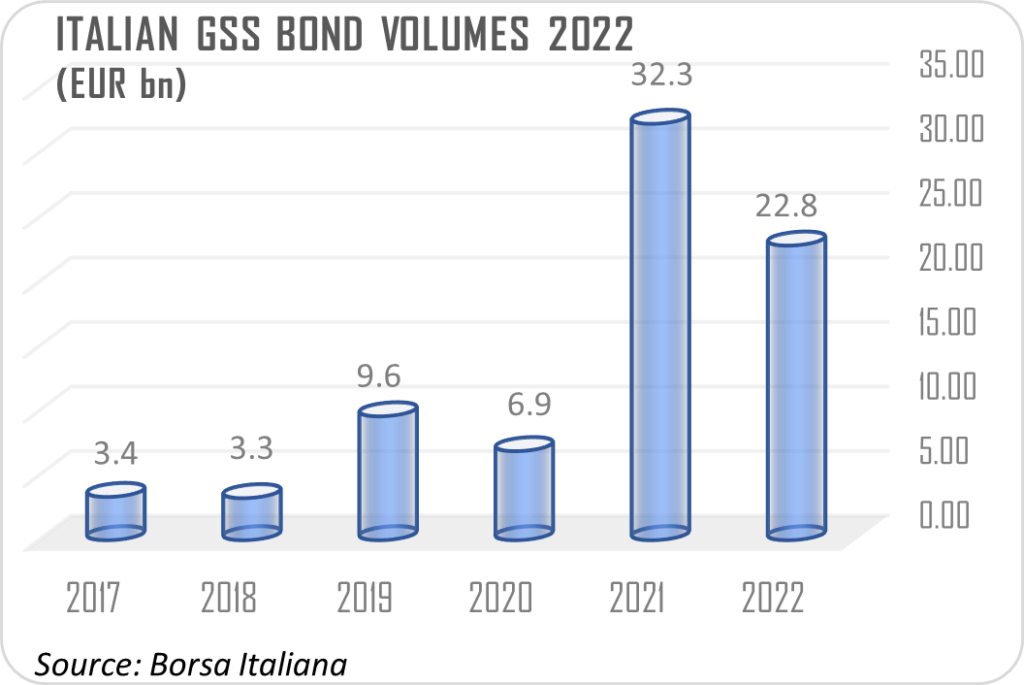

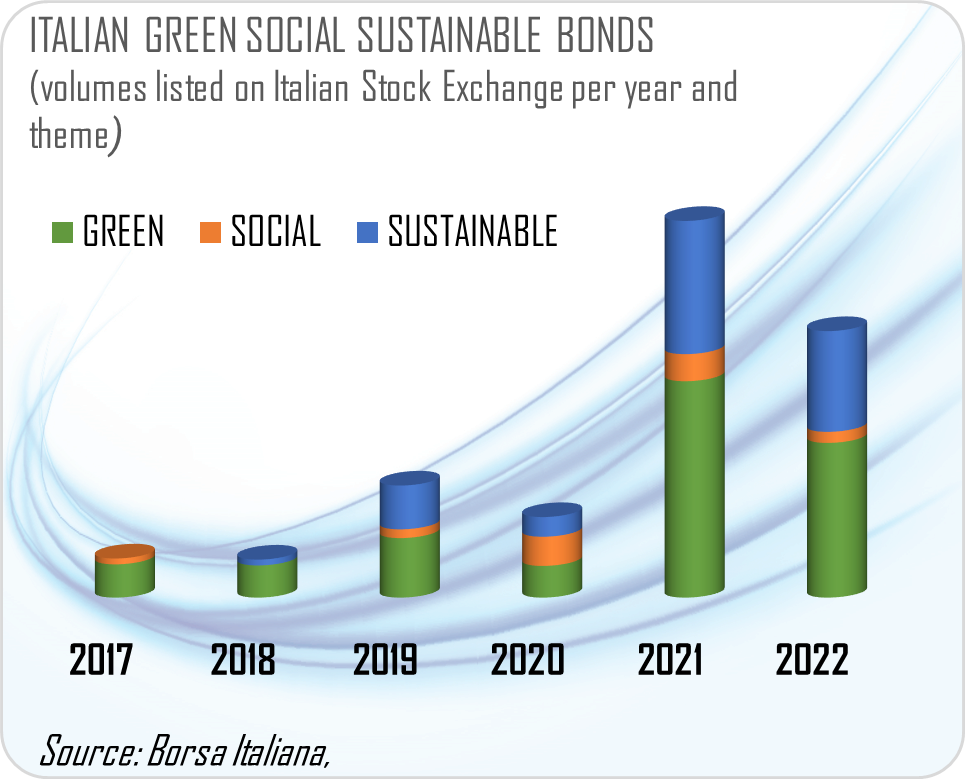

SustainAdvisory has completed the annual review of the Italian GSS bond market on instruments listed on the Italian Stock Exchange (‘Borsa Italiana’). Our findings indicate that in 2022 sustainable debt instruments, including green, social and sustainable or sustainability-linked bonds issued by Italian corporates decreased by 29.2% compared to 2021 with total volumes issued of EUR22.8bn against EUR32.2bn issued in 2021. The number of bonds issued also decreased by 27% counting 26 bonds from 33 issued in 2021.

Cumulative GSS bond volumes issued by Italian corporates, outstanding and listed on Borsa Italiana at the end of December 2022 reached EUR78.5bn for a total of 105 bond issued over the period 2014-2022.

The slowdown in growth of GSS volumes in 2022 was a common feature for the global debt markets and it was driven by rising inflation rates, geopolitical instability and the persistent energy crisis spurred by the conflict between Russia and Ukraine.

Volumes by quarters

Issuance of GSS bonds was extremely volatile in 2022 with 78% of volumes issued in the first and third quarter of the year. The second quarter was the scarcest with less than EUR2bn volumes issued.

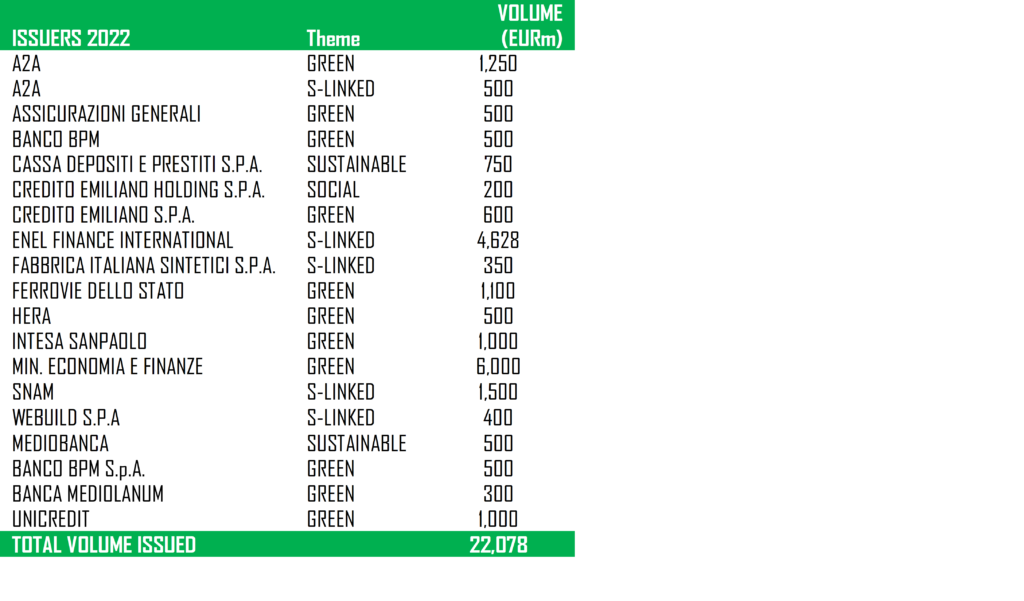

Issuers

Non-financial corporates and financial institutions accounted for 92% of the total number of bonds issued in 2022 reflecting the dominance of utilities and banks in the green (12 bonds) and sustainability-linked bond space (12 bonds), while the social bonds space counted only 2 issuances made by banks: Intesa San Paolo (EUR750m due in 2030) and Credito Emiliano (EUR200m due in 2032). 2022 was a record year for banks with a total of 10 bonds representing 38% of the total number of bonds issued.

Market Highlights Green was still the dominant theme with 58% of total volumes, but Sustainability-linked continued to grow year-on-year reaching 38% of total volume issued compared to 35% in 2021 and 24% in 2020.

Green was still the favorite theme by banks (5 bonds), followed by Social bond (2) and Sustainable bonds (2). Sustainable bonds are those where the proceeds are exclusively applied to finance or re-finance a combination of both green and social projects and shall not be confused with Sustainability-linked bonds that are those where the issuers are committing explicitly (including in the bond documentation) to future improvements in sustainability outcome(s) within a predefined timeline. SLBs are a forward-looking performance-based instrument.

Among non-financial corporates Sustainability-linked bonds (‘SLBs’) are increasingly popular with utilities: Enel Spa was on the market with five SLBs for a total volume issued of EUR4.6bn equivalent, SNAM with two SLBs for a total of EUR1.5bn and A2A with a EUR500m issue. A2A was back to the market during 3Q22 with two green bonds for EUR1.25bn positioning itself as a frequent issuer in the GSS market after Enel.

Green BTP

The Italian Treasury (‘Ministry of Finance’ or ‘MEF’) was also back to the market in 3Q22 with its Green BTP for EUR6bn due in 2035. Since 2018 MEF has issued a total of EUR19.5bn of green bonds.

In 2022 MEF published the Allocation report of Green BPT issued over the period 2018-2021. In detail, out of the total green expenditure, the transport category is the largest item (amounting to EUR 7.62 billion), accounting for 57% of the total. A large part of this category is attributable to capital investments (railway infrastructure, electrification of railway lines, construction of new high-speed/high-capacity sections and to contributions to support rail mobility).

Second category expenditure, in order of magnitude, was the protection of the environment and biological diversity, to which a share of 15.2% of expenditure was allocated (approx. 15.2% of expenditure (approximately EUR 2 billion). The category primarily includes measures to protect the soil and against hydrogeological instability, investments in water infrastructure, as well as expenditure for the construction of the Modulo Sperimentale Elettromeccanico (MO.S.E.) in Venice.

The energy efficiency category accounted for 12.2% of the expenditure total reported expenditure (EUR 1.63 billion). Research was allocated 9.4% of the total expenditure (EUR 1.25 billion), where the resources allocated to ENEA represent the most relevant item in the category.

Finally, measures for pollution prevention and control and the circular economy and those providing incentives for the production of energy from renewable sources accounted for 3.9% (525 million euro) and 2.2% (296 million euro) of total green expenditure, respectively.