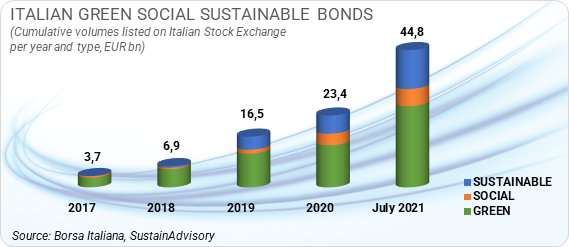

SustainAdvisory has completed a detailed review of the Italian green, social and sustainable (GSS) bond market on instruments listed on the Italian Stock Exchange. Our findings indicate that at the end of July 2021, sustainable debt instruments, including green, social and sustainable or sustainability-linked bonds cumulative outstanding issued by Italian entities amounted to EUR44.8bn for a total of 69 instruments issued. Debt issued by Italian entities represent only 16% of the total sustainable debt instruments listed on the Italian Stock Exchange, which include domestic, non-domestic and supranational entities amounting to EUR275bn for a total of 211 instruments issued since 2012.

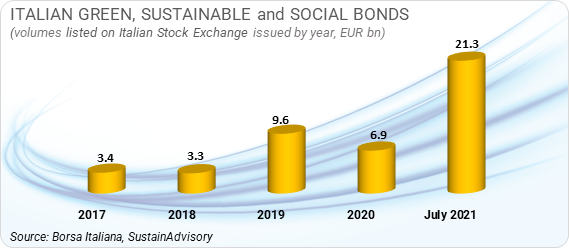

Between 2017 and 2019 Italy’s GSS bond volumes tripled, while in 2020 due to the Covid-19 pandemic, volumes dropped by 28% on 2019 level. However, debt issued in the first seven months of 2021 reached EUR21.3bn, suggesting that total volumes’ growth by year end could well exceed 30 billion euros. While this would be a record year for Italian GSS’ debt issuance, it is still well below the GSS bond volume issued in France and Germany (c. EUR94bn and EUR46.5bn respectively in 2020), the two largest markets for green, social and sustainable debt in Europe.

Government, Blue Chips Major Issuers

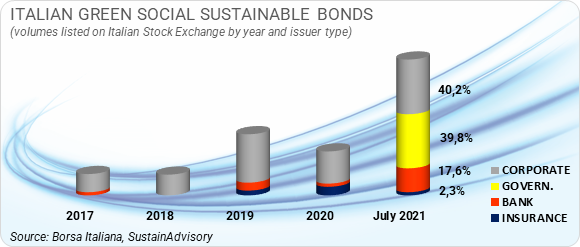

More than 60% of Italian GSS are originated by non-financial corporates, 13% by banks, 3% by insurance companies, and 19% by the public sector. The non-financial corporates are dominated by utilities (Enel, Hera, Iren, Acea, Eni) or infrastructure companies (like Terna, Snam and Ferrovie dello Stato) with some frequent issuers like Enel Spa that are active in more than one thematic area. In fact, Enel was the first and largest issuer of sustainability linked bonds with a total of EUR 6.3bn and EUR3.5bn of GSS bonds. The second largest issuer is the Italian Government: with the inaugural green bond in the BTP format, Italy placed EUR8.5bn in March 2021. The bond, designed to support public expenditures with positive environmental impacts, received offers for 10 times the amount requested.

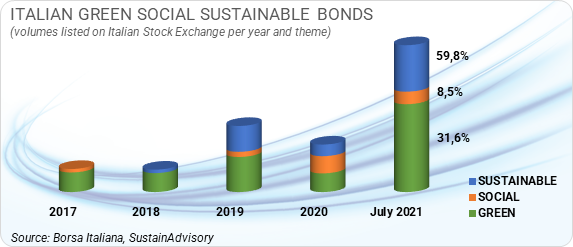

Green dominant theme, social bonds expected to grow for SMEs

Green is the dominant theme of Italian bond issues followed by sustainability and social bonds. Social bonds appeared on the Italian market in 2017 and grew noticeably in 2020 in response of the COVID-19 pandemic. However, in the first seven months of 2021 sustainable and sustainability-linked bonds show the strongest growth together with the green theme, while social bonds decreased. The largest issuers of social bonds were financial institutions that supported government guaranteed SME lending during the coronavirus pandemic. SustainAdvisory believes that social bonds will continue to grow and be applied to purposes correlated to the post-pandemic recovery plan launched by the EU to support the private sector of member states and mitigate the unemployment risk of private individuals employed in sectors highly impacted by the pandemic crisis.

EU institutions push GSS bond issuance growth

According to a report published by Climate Bond Initiative (CBI) last week, at the end of the first half of 2021 the volume of green, social and sustainable (GSS) cumulated debt at a global level reached USD2.1 trillion. Volume issued in the first half of 2021 (USD 496bn) is almost double the volume issued in the first half of 2020. In 2020 Europe (EU27) was the largest GSS market with USD589bn of debt outstanding, 1458 bonds issued and 405 issuers. The EU itself is one of the largest issuers, followed by France and Germany. According to CBI’s report, the GSS market will continue to grow at considerable rates in the future. The drivers of such growth in Europe are linked to the EU climate policy agenda, the Covid-19 recovery expenditures, the roll-over of the taxonomy regulation as well as the ECB policy that included green bonds as acceptable collaterals in the quantitative easing program.

Outlook

SustainAdvisory believes that the GSS debt market in Europe and Italy will continue to grow. The first driver of growth is the deployment, at the EU level, of the EUR750bn Next Generation EU (NGEU) recovery plan established to support member states hit by the COVID-19 pandemic. At least 30% of these resources are dedicate to expenditures compliant with the Paris climate accord and in line with the objectives of the European Green Deal, the EU flagship initiative to address climate change and achieve carbon neutrality by 2050.

Italy is the largest beneficiary of the recovery package with c. EUR 200bn of allocations. The national plan (PNRR – Piano Nazionale di Resilienza e Ripresa) that the Italian Government submitted to the EU describes the strategy concerning the investments to be made under the Next Generation EU (NGEU) package. PNRR defines six areas of intervention, including: the green revolution & ecological transition and the infrastructures for sustainable transportation. Together these two areas will absorb c. 43% of the available funds and will create green and sustainable assets. Although the NGEU do not provide any direct support to the private sector, it can be expected that the public spending will be a strong leverage for private investments that will find in the GSS debt market the most adequate financial instruments.

The way forward

The Italian GSS bond market is on a strong growing path but still well behind France and Germany, the largest GSS bonds markets in Europe. Most of the issuers are large and very large entities, while small and mid-sized issuers are very few; considering the strong demand for this asset class from investors this could be a missed opportunity to many mid-corporates. Social bonds are on the rise but are mostly linked to the funding of SME support due to the pandemic; the Italian PNRR will pursue many social objectives, like education, health, inclusion, culture therefore there will be more opportunities to increase and diversify the use of this instrument.