Europe is the largest market for sustainable passive funds with 188.8USD billion (as of June 2020) accounting for 76% of total global sustainable assets. According to a recent study by Morningstar, assets have more than quadrupled in the last 5 years. How does Italy fit into the European landscape? And how is the Italian market evolving?

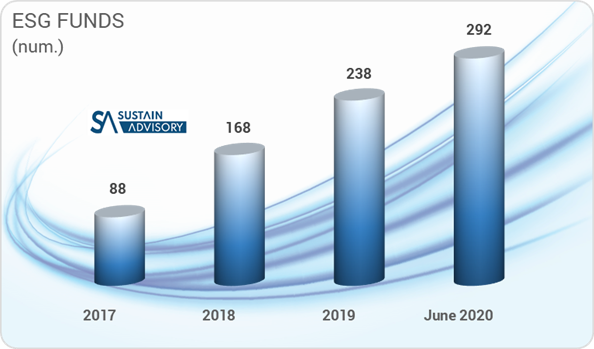

SustainAdvisory has analyzed the data published by Assogestioni of almost 300 Italian sustainable and responsible open-ended funds, i.e. funds that give priority to investments in securities by entities that integrate environmental, social and governance criteria (ESG), which as of June 2020 involved about 60 asset managers (Italian and foreign) belonging to 40 groups.

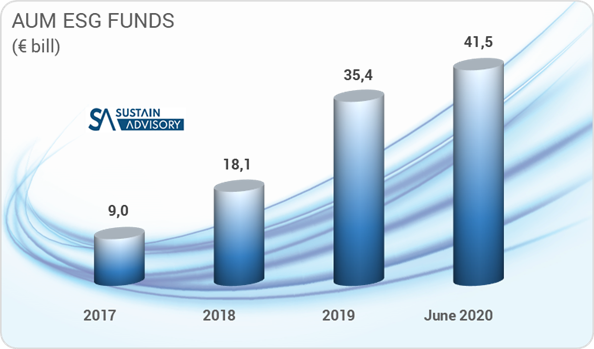

The picture that emerges is indicative of positive dynamics of the Italian market in recent years, with growth rates aligned with the European trends. In 2018 and 2019, assets under management (AuM) and the number of sustainable funds doubled year on year. AuM reached 41.5 billion euros in June 2020, a 4.6x multiple of AuM at the end of 2017. Over the same period, the number of sustainable funds more than tripled to almost 300.

The Italian market for sustainable funds under management accounts for 21% of the European market; however, the share of sustainable and responsible funds versus total AUM remains very limited, around 4% of open-ended fund assets, but has shown growth rates of 80% on average over the period 2017- June 2020.

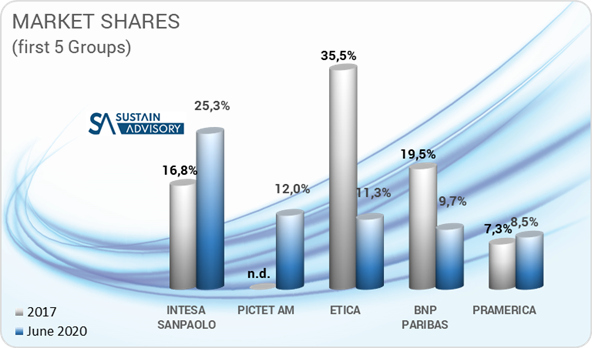

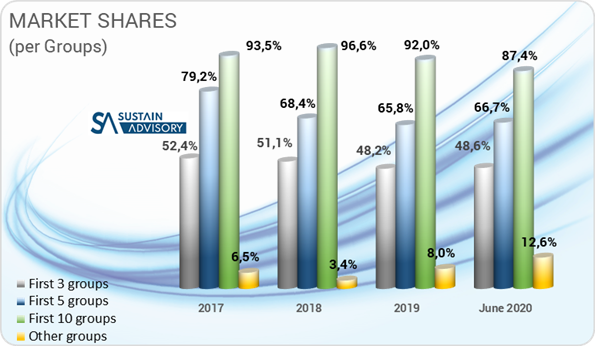

Although the number of sustainable fund managers is growing, the market is still concentrated on a few names. In terms of AuM per group, the top 10 players (around a quarter of the total) continued to hold more than 90% of the assets until 2019, and only slightly decreased to 87.3% as of June 2020.

The top three groups still manage almost 50% of the assets, while the leader owns a quarter of the market, with AuM now more than twice the size of its two most direct competitors. The share of the remaining managers, although doubling since the end of 2017, is still small in terms of both assets and number of funds.

It should be noted that the market positioning of the main operators has undergone a significant change in these two years and a half: while in 2017 the market leader (with more than a third of the assets) was an asset manager specializing exclusively in sustainable and responsible mutual funds, in June 2020 the largest operator belongs to a banking group.