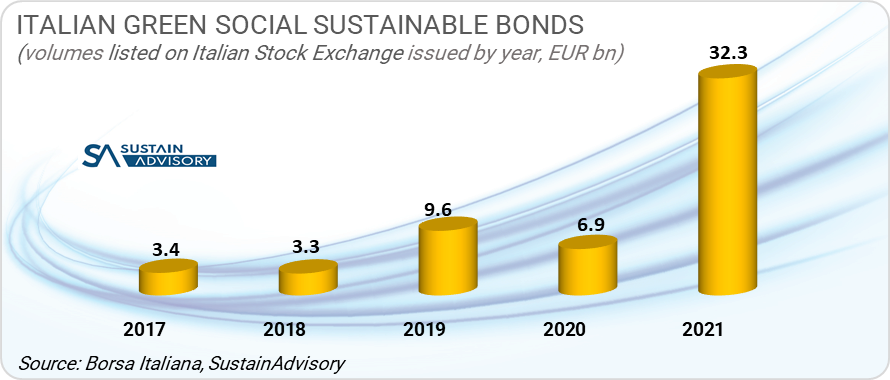

Confirming SustainAdvisory’s mid-year forecast, GSS debt issued in Italy in 2021 exceeded EUR32 billion, a multiple of 4.6x compared to 2020 issuance which stopped at EUR6.9 billion, a true record for Italian green, social and sustainable (GSS) debt issuance.

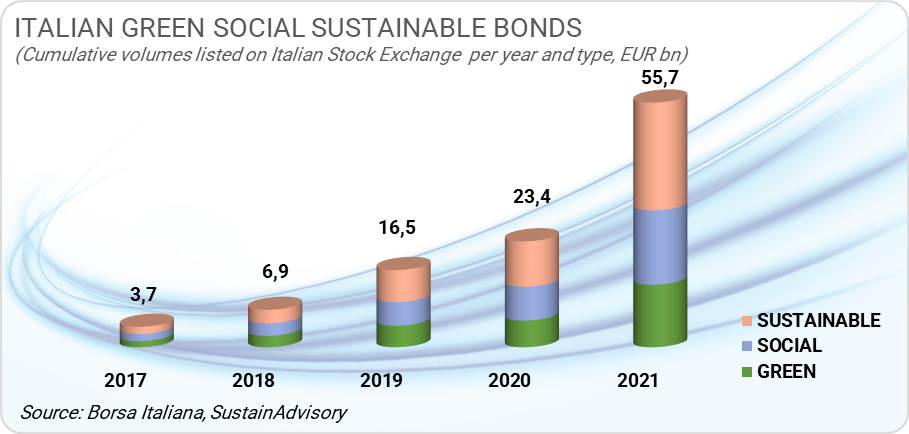

Based on preliminary data, therefore, at the end of December 2021, cumulative green, social and sustainable bonds issued by Italian entities reached EUR55.7 billion for a total of 79 instruments outstanding.

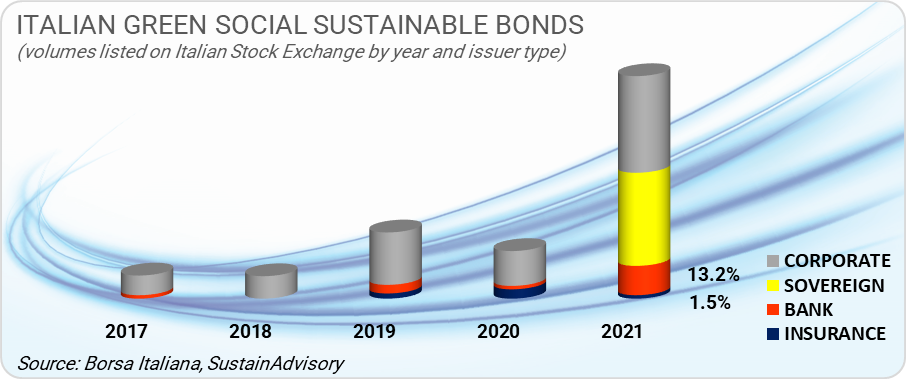

The record was driven by the Italian government which, with a total of EUR13.5bn, or 42% of total GSS debt issued, in two issues of BPT green respectively EUR8.5bn in March and EUR5bn in October, also confirmed itself as the most requested issuer given that it received bids for 10 times the amount requested.

The non-financial corporate segment follows with 43.4%, with the utilities sector leading the way, in particular ENEL Spa, with EUR 6.75bn of new issues made in 2021, but also Hera, Acea, A2A, which with one or more issues represent almost 30% of the total.

Banks issued just over 13% of total volumes during the year, with a slowdown in issuance especially in the last quarter of the year. The same is true for the insurance sector, which stopped at 1.5%.

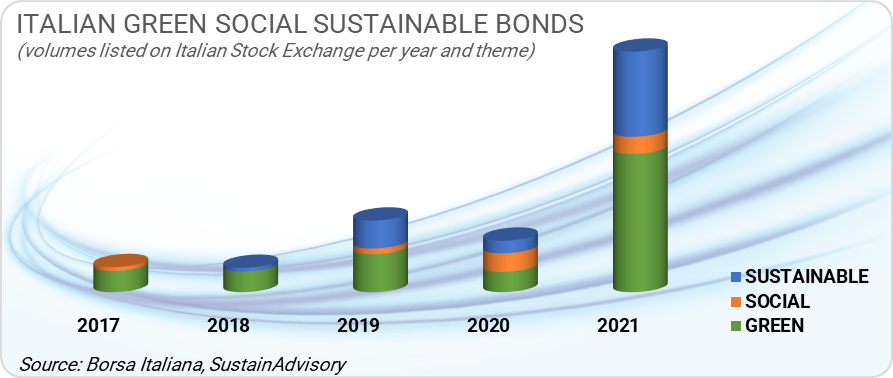

The green theme remains dominant with 57.4% of emissions in the year and 58% of cumulative emissions. The social theme, after a very promising start to the market with 36% of volumes in 2020, mainly related to pandemic issues, stopped at just over 7% in 2021 and on cumulative issues comes to 10.8%. What was new in 2021, however, was the increase in Sustainability-Linked bonds, which accounted for 35.4% of 2021 issuance and 31% of cumulative issuance, indicating a trend that will continue in 2022.

The clear leader in Sustainability-Linked bonds was Enel. Of the EUR10.4bn of volume issued in 2021, EUR6.75bn, or 65%, was offered on the market by the Enel Spa group. Other S-Linked issuers include ENI, A2A and Hera in the energy/utilities sector. In the fourth quarter of the year, a Sustainability-Linked bond was issued by the retail group OVS S.p.A..

Climate Bond Initiative data

According to an estimate by the Climate Bond Initiative (CBI), the volume of green, social and sustainable debt (GSS) in 2021 globally will reach $500bn and cumulatively exceed $1.5 trillion. Europe is the largest market: at the end of the first half of 2021, $121.3bn (EUR105bn) of ‘green’ bonds issued. Italy was the sixth largest country after France, Germany, the Netherlands, Spain and Sweden. Volume growth in these countries was also driven by green debt issued by governments (sovereign debt).

Considering the recovery stimulus actions generated by the Recovery and Resilience Facility (RRF) set up by the European Union to address the effects of the pandemic, it is likely that the GSS debt instrument will be used again to support the Recovery and Resilience Plan (RRP) investment measures of member countries.